Climate Change Initiatives

- Policies and

Management Structure - Climate Change

Initiatives - Environmental

Initiatives - Social

Initiatives - Governance

Initiatives - External assessment

- Sustainability Report

(Issued July 2023)

Awareness of Climate Change

MORI TRUST Asset Management(MTAM) recognizes that climate change is an important issue that brings about dramatic changes to the natural environment and social structures, and has a serious impact on their operations as well as businesses overall. The background to this is global trends in greenhouse gas emissions regulations, such as the Paris Agreement adopted in 2015, and the progress of climate change as a scientific fact presented in reports such as the IPCC Special Report*. The Paris Agreement aims to limit global average temperature increase to below 2°C compared to pre-industrial levels, and below 1.5°C as an effort target. International frameworks and domestic regulations to reduce greenhouse gas emissions are expected to be toughened in the future as a result of this. MTAM also recognizes climate change as a scientific fact, and takes the position that measures to address the spread of natural disaster damage caused by climate change—such as intensifying typhoon damage, frequent heat waves, and a rise in global sea levels—are essential.

MTAM formulated a Sustainability Policy in March 2017, and has since been working to improve investor value in the medium to long term, through initiatives to improve sustainability. In March 2021, we formulated a list of material issues relating to MTR, and recognized responses to climate change and resilience as important issues by including them in this list.

(Note) The IPCC Special Report on Global Warming of 1.5 ºC published in 2018 by the Intergovernmental Panel on Climate Change (IPCC).

Declaration of Support for the TCFD Recommendations

MTAM recognizes that climate change is a serious risk that threatens financial stability. In recent years, many stakeholders—primarily investors—are demanding disclosure of information on the financial impact of climate change.

Based on this recognition, In March 2022, MTAM declared its support for the recommendations announced in June 2017 by the Task Force on Climate-Related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB).

In order to secure MTR's sustainable and stable profitability in the long term, it will be essential for MTAM to enhance the resilience of its businesses by identifying, assessing and managing risks and opportunities that may be brought about by climate change. We will expand disclosure of information on these risks and opportunities in the future, in line with the TCFD recommendations.

Governance Relating to Climate Change

MTAM has established the following organizational governance system to respond to climate change-related risks and opportunities and promote and supervise matters relating to climate change.

(Chief executive responsible for response to climate change)

President & Director

(Executive officer responsible for response to climate change)

General managers of the Business Administration Department , and Strategic Management Department, Investment Management Department.

(Matters for discussion and reporting at the Meetings for Promotion of Sustainability)

・Identification and classification of impacts of climate change

・Managing risks and opportunities

・Progress of adaptation and mitigation initiatives

・Climate change responses such as setting indicators and targets

ESG Policies and Management Structure > Meetings for promotion of sustainability

Strategies

In order to consider climate-related risks and opportunities in the real estate management industry (MTR's industry), MTAM conducted a scenario analysis for MTR's portfolio. The outline of the scenario analysis is as follows. MTAM's process for identifying and evaluating risks and opportunities is presented under "Risk Management" described later.

Climate Change Initiatives > Risk Management

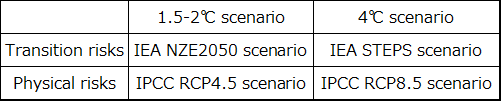

Reference scenarios

※ IEA:International Energy Agency, IPCC:Intergovernmental Panel on Climate Change

Assessment of identified climate-related risks, opportunities and financial impacts

*Timeline: Mid term (–2030), long term (–2050)

MTAM has determined that climate change carries medium to long-term risks, but at the same time also sees them as a chance to create new business opportunities.

Based on this scenario analysis, we will continue working to improve the resilience of MTR's asset management operations.

Please refer to the following for examples of climate change initiatives.

Environment Initiatives >Examples of Environment Initiatives

Risk Management

MTAM identifies, evaluates, and manages climate-related risks under the following framework.

Process the organization uses to identify and evaluate climate-related risks

MTAM regularly reports the results of the identification and evaluation of the impacts of climate change to the Meetings for Promotion of Sustainability.

Climate Change Initiatives > Governance Relating to Climate Change

Process the organization uses to manage climate-related risks

Climate-related risk management is integrated into and managed based on the following company-wide risk management programs.

Please see the following regarding outline of the company-wide risk management program.

Governance Initiatives > Risk Management Initiatives

Metrics and Targets

MTAM uses indicators and targets to monitor its efforts to reduce the impact of climate-related risks and actualize opportunities. The goals currently set by MTAM in relation to climate change issues are introduced below, along with corresponding achievements.